Amtrak notches ridership and revenue record for fiscal 2024

November 27, 2024

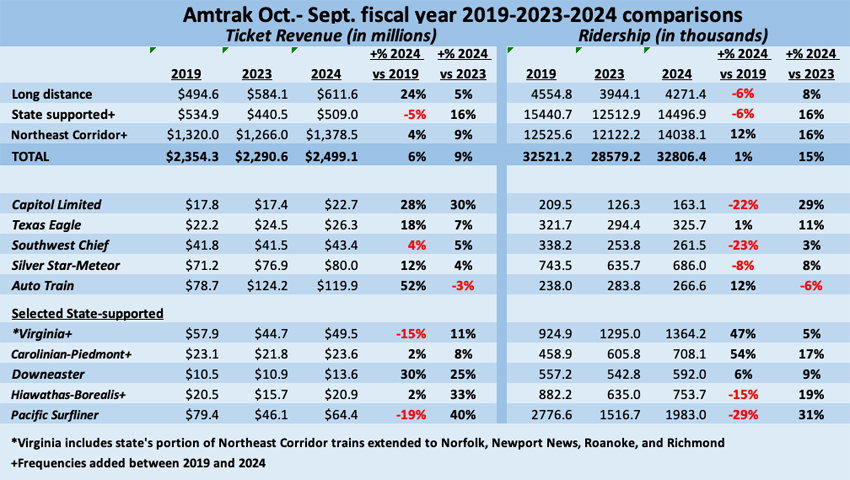

Trains Article Analysis - WASHINGTON — The increases weren’t large compared to pre-pandemic 2019, but more Northeast Regional frequencies enabled Amtrak to capture enough travel demand to beat the company’s previous overall record ridership in fiscal 2024. Also, a 24% gain in ticket revenue from long-distance trains compared to 2019, in spite of constricted coach and sleeping car capacity, generated a 6% rise in total revenue.

These are among the takeaways from Amtrak’s fiscal year ending Sept. 30, as revealed in the 2024 monthly performance report released late last week. A table below provides a closer look at how price and patronage interact on some services.

The money generated on trains that travel more than 750 miles (even if passengers aboard might not) is up sharply from 2019. Diminished capacity led to fewer riders on trains like the Texas Eagle, which operated with more sleeping car capacity (it had a transition sleeper) and additional coaches. The situation has recently been partially rectified [see “Amtrak adds to Texas Eagle capacity …,” Trains News Wire, July 29, 2024]. Southwest Chief patronage suffered because, until recently, it was routinely assigned only two Superliner coaches when the train previously had three or four in peak season. On the other hand, the Capitol Limited’s expansion of coach and sleeping car capacity between 2023 and 2024 paid immediate dividends. Another success story is Auto Train, the only long-distance train that maintained daily frequencies throughout the pandemic. It capitalized on higher gas prices in 2023 but marginally lost clientele in 2024 when gas prices retreated.

Added frequencies create exponential ridership gains

Hands-on management and a reliable funding commitment at the state level have allowed Virginia, North Carolina, and Maine to actively promote their service and add round trips. Price reductions coupled with more Virginia-sponsored frequencies to Norfolk and Roanoke have resulted in sustained growth, while additional Piedmonts between Raleigh and Charlotte, N.C., have made the service more relevant. Both Wisconsin’s Hiawathas and California’s Pacific Surfliner were among the operations hurt by a change in commuting patterns; landslide disruptions on the route to San Diego also injected cancellations. But the introduction of the Borealis as an extension to one of the Hiawatha round trips, providing an extra frequency on the previously once-daily Empire Builder route to the Twin Cities helped counteract that shortfall.

Capacity, frequency yields dividends

The complete document available on Amtrak’s website contains a variety of other “route level results.”

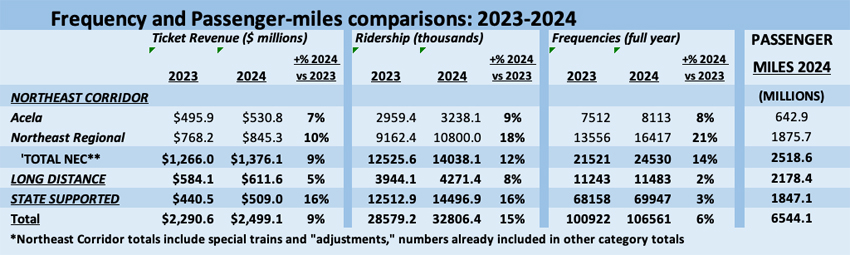

The table below, derived from that section, shows that a key factor in the Northeast Corridor’s strong performance is how the number of train starts grew from fiscal 2023 to 2024 (comparable data was not provided in the 2019 report). This was accomplished by introducing quick terminal turns with push-pull equipment for Northeast Regional trains and squeezing more departures out of an Acela fleet in which trainsets have been permanently sidelined. The small increases in the other categories were the result of Amtrak’s belated return to daily operation of some long-distance trains in the fall of 2022, and more Cascades, Piedmont, and Virginia round trips.

Also note the relationship between length of trips and frequencies. The Northeast Corridor’s 24,530 trains produced 2.5 billion passenger-miles while the long-distance network generated about 2.2 billion passenger miles with 13,047 fewer departures. Meanwhile, state-supported service delivered the fewest passenger-miles with almost 70% of the trains. While all these numbers may make eyes glaze over, they show the ways beyond ridership and revenue that Amtrak’s network can be valued.